The 50-year plan? There are two major sections to your financial life in retirement planning: accumulation and distribution.

In the accumulation phase, investment advisors and financial planners generally work on helping you amass some cash for your retirement. They commonly work on trying to anticipate or defend against investments’ volatility, and year-by-year. “Our analyst believes…” is a common refrain.

What is not addressed as commonly is the distribution phase, when you take money from your savings and investments to pay for your retirement and all that goes with it.

Too frequently, financial planners do not address retirement as they help you plan for retirement. Crazy, right? Discussions about health issues or inflation and more…these concerns don’t always fall into the business model or sales approach planners often lean on.

And here’s the big one: how will you handle investment volatility in those later years? When market drops occur, how long will you be able to wait for recoveries? Going back to work might be difficult. If you handle your accumulation phase (aka saving and investing) strictly through the currently conventional stock market applications, you will likely be resigned to more of the same in your later years.

So, imagine yourself to be 82, and paying for retirement through your IRA or other investment accounts. Now imagine the markets drop 35%. What do you do? Volatility, in retirement, is not a warm hug, is it? What if tax rates go up? Will you have an increasing tax exposure?

We work on “50-year plans” to create as much certainty and consistency as we can find. We work with minimum guarantees, relative consistency of annual growth, and simplicity when it counts…when you will most appreciate it. Yes, you will appreciate it in the accumulation phase, but even more when you are retired and not interested in stock market tantrums. And funny thing…your investment returns to-date might not be what you think! Scroll to the bottom here and click the link to get an explanation.

We assume every one of our clients will live to a ripe old age. People plan as if their advisor will always be reachable and miss the idea that the advisor might disappear before they do. Complexity in plans represents increasing danger as we age. We know that we might not be available when, in 40 years, a client turns 97 years old. We try to design plans that are usable even then for that client: simple and reliable.

So, if you’re 40 or 50 years old, the 50-year plan is for you. If you’re 30? Well, that becomes the 70-year plan. We believe the core of the plan must incorporate certainty and safety. Stock market plays? Sure, but on the edges.

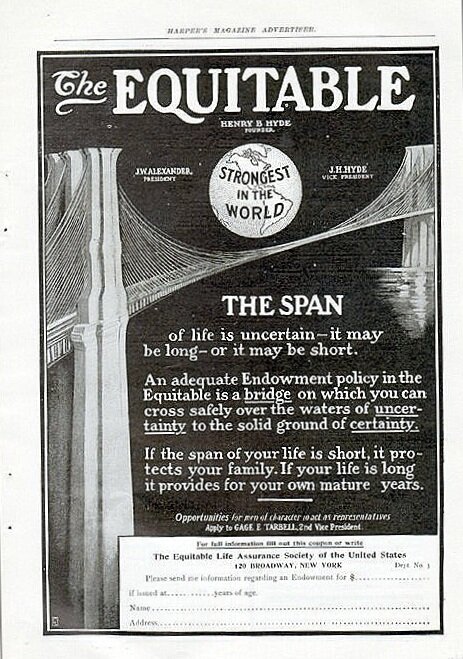

We use a form of “Participating Whole Life Insurance” from Mutual insurance companies, as has been done for more than 160 years. This is not the entire strategy but certainly a major portion of it. Here are ads from the past to provide some insight: this is not new, but a proven strategy. To be clear, we do not use any form of Universal Life insurance (UL, VUL, IUL, GUL…) as UL is an entirely different animal and quite dangerous.

The Equitable Life Assurance Society - 1904

EQUITABLE LIFE, LATER KNOWN AS AXA EQUITABLE, AND NOW EQUITABLE LIFE

HARPER’S MAGAZINE advertisement

“If your life is long it provides for your own mature years.”

Mass Mutual - 1951

THE SATURDAY EVENING POST advertisement

Your Retirement

“…arrange to get a guaranteed income for yourself…/…with no investment worries.”

Mass Mutual - 1961

THE SATURDAY EVENING POST advertisement

“One of the simplest and surest methods of family saving - for education of a youngster, owning a home, a future business opportunity, emergencies, your own retirement years - is through …. cash value life insurance.

“This insurance provides both protection for a family and investment. Your first payment creates an immediate estate…as you begin to accumulate an investment fund. Your cash values increase year by year…”

Over the years, life insurance policies have evolved. There are more riders, more variations…but a funny thing happened along the way: a number of old-line “mutual” insurance companies became public companies. That change, from mutual to public, is demutualization. That change in corporate structure resulted in changes in policy design as well, and fewer companies that are attuned to the approach we use for your benefit. We only use mutual companies, and only a handful of those. An important point: the structure of the policies we use have survived (without a hiccup or losses) The 1st World War, The 1918 Pandemic, The Great Depression, The 2nd World War, The Tech Bubble Collapse, The Great Recession, and are still going strong. You see, once the cash is in the policy, a drop in cash value would have to be caused by you, the owner of the policy; there is no link to the stock market.

Averages and volatility

Over the last 40 years, we have, as a society, experienced some amazing, exciting, and difficult times in the world of finance. There was "The Roaring Twenty", ~1980 - 2000, when the stock markets roared unlike any other time in history. We saw a "Tech Bubble" collapse in 2000 - 2001, and the "Great Recession" in 2007 - 2009. And since 2020, we have that “Black Swan”, the coronavirus pandemic. Wondering about future Black Swans?

Financial industry marketing has led to growing assumptions and (now) conventional beliefs that are simply not accurate. Unfortunately, many of us leaned on these inaccuracies to plan for our financial future and then wondered why results did not come out as advertised.

We’re uncomfortable with the standard use of:

"Average Returns"...these are not the same as actual returns, and can destroy your financial life

Straight-Line Projections, using historic averages...this leads to nonsense

Volatility...this can destroy growth and compounding

Financial Planning is good if realistic. "Realistic" requires more than "let's be conservative by using 6.75 instead of 7.75%!"

Read more about this topic on our blog:

https://www.himelfinancial.com/blog/2020/5/13/vi3qzpzqd3qj6e4za4fssbkze29cw3